Onboarding project | Superbottoms

Why Superbottoms - Journey, Challenges & Strengths:

Growing up I saw a lot of ads that did not matter for almost 29 years of my life, as they were related to baby products and had no relevance for me. Suddenly, the day I became a mother, everything changed. I started reading more, researching more on all products that I would need for my kid and finding out better alternatives that work, are not too costly and make our lives a little easy as new parents. Trust me any woman who has gone through the 3rd trimester nesting phase can hard relate to this!!!

A thought that transcends gender, nationality, class, financial status, social status, etc. is that 'Every parent wants the best for their children'. Affordability and geography impact the final 'what' you can offer but the want is always there. And one of the primary want for new parents is a good solution for the 'POOP' situation - what diapers, how many diapers, what wipes, how many wipes, what changing station, etc.

Also, the number of diapers that a child goes through if you are using only disposable ones, each child can have his own little diaper mountain and a BIG chunk of the family income (middle class) ends up in solving for poop related things!

After learning about all this, one cautious parent, Pallavi Utagi, wanted to find the best diaper for her kid and was thoroughly disappointed in her search. She was looking for an affordable, durable and comfortable cloth diaper that wasn't a traditional langot. This search brought her to the conclusion that like her many mothers are searching for the best diaper with no results that tick all the good boxes giving the best of both worlds, and that is how 'Superbottoms' was born!!

While dadis and nanis keep on saying that use a langot or cotton threaded cloth to save from rashes, in today's time it is practically difficult to execute. And although disposable diapers seem convenient for the working, neutral busy families, they come with their own set of problems like rashes, bulk to carry while travelling, environmental issues, not sustainable, habit forming that leads to longer time to potty train, etc.

Superbottoms came up with a solution that gives us the best of both worlds i.e. a cotton like soft material that ensures rash-free bottoms, can be washed by hand or machine saving time & being travel friendly (most of the times), does not lead to unnecessary waste generation, etc. Another differentiator for Superbottoms has been the mom community. As someone who faced challenges in returning to the workforce after having a kid, Pallavi decided to make her company a mom first company and customers became employees, new moms were preferred in the hiring process with the additional requirement that their kid must be a superbottoms user.

While the journey does seem noteworthy, it came with it's own set of challenges. To name a few, they were entering a market which had pretty big well known brands with big money to invest in marketing and distribution. Another issue was the replicability of the product, although not easy but not impossible either and they faced it very soon after launching & gaining popularity. Big brands like Pampers also started launching cotton diapers competing in the exact same segment as Superbottoms, they had soon lost their first mover advantage. But their biggest strength was not the product or VCs that kept them afloat during all these times, it was actually the mothers community that they built. Their product differentiation & continuous feedback & iterative launches helped them stay ahead of the curve while everybody else followed suit. They gave new mothers a safe space & forum to discuss their issues and needs, be it from feeding to discussions on maternity leave & work. They have an active Facebook, Instagram and WhatsApp community that helps mothers on a variety of topics and it is also an important part of their onboarding journey. A large chunk of their sales and product testing happens via this medium, they run a lot of programs for mothers to come and help in building the company.

Why did I choose Superbottoms for this assignment?

I am a DAU for Superbottoms, rather my 1.5 year old daughter is. I have used a wide variety of their products for my child for more than a year and have advocated other moms to try their products as well, they make life a little easier when you have a toddler running all over the place.

Also, I strongly relate with the founder, her struggles to make a passion project into a full fledged career, trying to make a mark in the male dominated VC world all while taking care of a growing child and their needs. I believe this category & company have huge growth potential and other than the obvious benefits, the sustainability factor is important in today's context.

Challenges Superbottoms is facing today:

- Segment first mover, now facing heavy competition - Copycat products have entered the market, eating away market share and reducing differentiation

- Low repeat orders as customers are buying some products from each brand to try and do not know what to with the extra orders

- Marketplaces like Firstcry & Amazon make up a good margin of their overall sales but categories and sizes are not mentioned/sold correctly on these platforms. For ex. you cannot choose a size for your kid when you purchase padded underwears despite a size-chart being present, so you don't know what you will receive when buying from FirstCry.

- Lower awareness about their products that cater to special needs kids or women or bed-wetting older kids - lower sales in these categories

And these are solvable challenges on the product, sales & business end by implementing the right strategies.

Product Value Proposition and Sales:

Superbottoms USP products are their UNO 2.0 diapers and padded underwears. These are made with a material that is certified across boards (USA, Australia, Europe, etc.) and have no chemicals that can cause irritation or rashes to the kid. The material absorbs water (pee) while giving a dry feeling to the child and the outer layer is also made of a material that ensures that clothes (of the kid & the person holding the kid) do not spoil. It lasts relatively longer than traditional langots but shorter than good quality disposable diapers making it a good use case for daily home wear usage.

Another advantage is that unlike disposable diapers or cotton langots, most of the diapers are adjustable for size and a single fit can be used for kids from 3 months to 3 years increasing shelf life. A differentiator about these diapers is that instead of single colours or whites, they have eye-catchy, cool and cute prints and these are updated regularly and a primary attraction for a lot of parents. They claim that a single diaper can be used upto 300 washes while keeping the quality intact. They also sell detergents specifically to be used for their diapers that increase the longevity of the diaper and keeps it like new. These diapers can be hand-washed and machine washed without any impact on quality, the product packaging comes with a detailed explanation on how to wash and maintain the product.

Since it is not a regular diaper, they also have a detailed buying guide (on the website) and washing guide (as part of packaging) made available. For building trust on the brand, they have onboarded celebrity moms like Alia Bhatt and Neha Dhupia to promote the brand. To show that they care about their customers, they started 2 programs - 1. Book a free demo - Online or at Home - get an idea about the products, how they are used and benefits from your 'SuperBuddy'; 2. "Use & Return" Trial policy - Use the UNO product for 15 days and if you are not satisfied, you can return the product.

As of 2023, 45% of the sales come from their website while the rest was divided between physical stores (own & retailers), ecommerce marketplaces (Amazon, Firstcry, Flipkart, etc.) and quick-commerce (Zepto, BlinkIt). Since the data for these is not readily available, fragmented and difficult for assessing activation, for the focus of this onboarding journey, we would look at their website as the primary channel for activation & onboarding journeys. A 2023 report gives the following stats on their progress so far:

They are Series A funded company with the last round completed in Aug 2023 worth $5mil totaling their overall fund raise to $10.5mil

Further details on the revenue and investments:

Superbottoms has good potential as they increase the product categories and user base (larger age group of kids covered & women-centric products).

Competition & Current Standing:

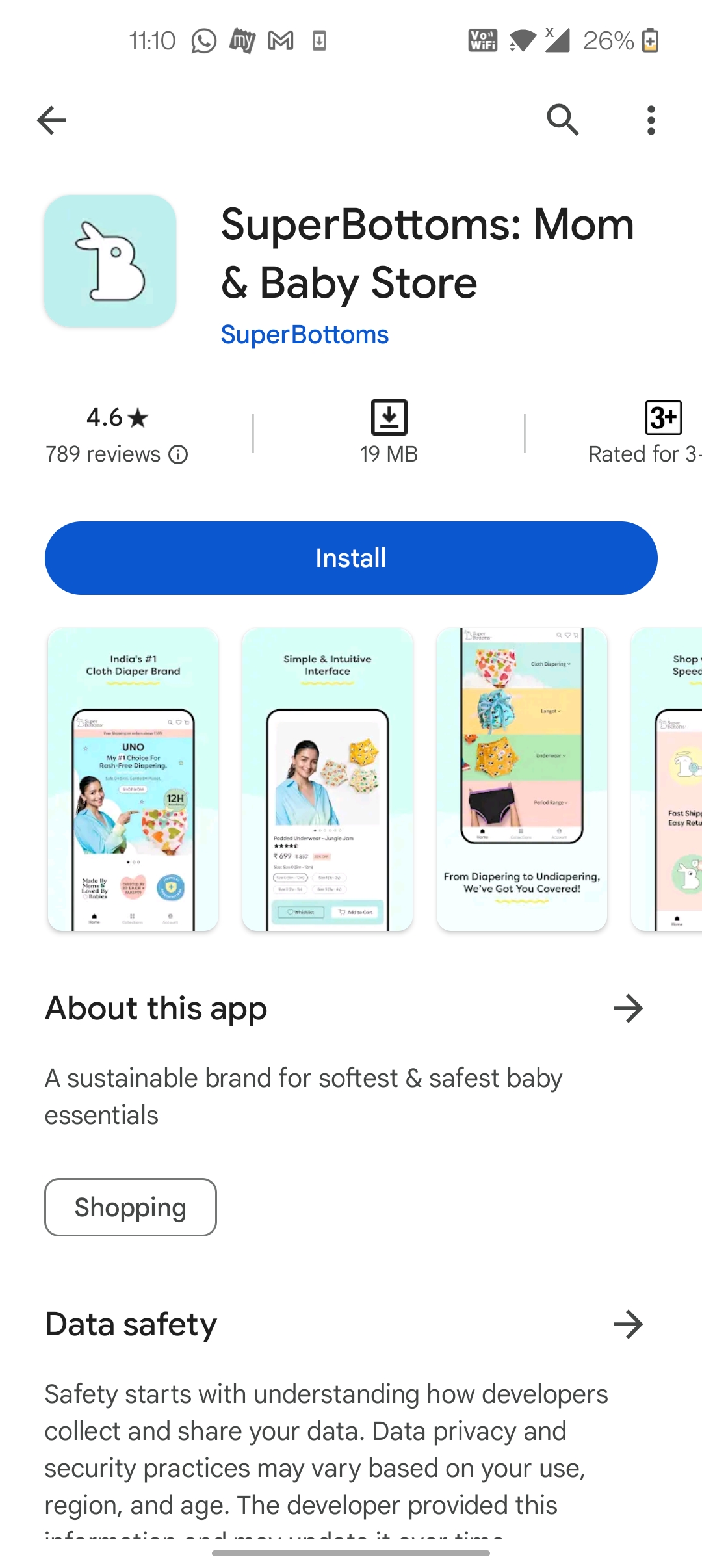

Currently Superbottoms (as claimed by them) has served more than 20lakh customers with a google review of 4.6 (990 reviews).

Demographic distribution for the platform: The most active age group is new or relatively new parents but the surprising part is the gender distribution. Most of the data that Superbottoms collects and as per reviews as well, majority of the purchase is done by women but here male % is higher than that of female. This could be attributed to various things like wives using their husband's phone to do the final purchase, fathers also checking out the product when they want to contribute to the buying decision as influencer or blocker, etc.

Device distribution for the platform:

They have ranked #1 as per Tracxn amongst identified competitors in this segment. Being a first mover in the category, Superbottoms may rank better than competitors but there are indirect competitors in the disposable category that cater to a much larger customer base (Pampers, Huggies, BabyHug, MamyPoko, Himalaya Babycare, Mother Sparsh, etc.). As per Economic times, the Indian diaper industry is currently pegged at about Rs 10,000 crore where Procter & Gamble controls nearly 38.3% and Unicharm at about 38.9% as of December 2023. As a category within consumer goods, diapers have one of the highest sales coming from online channels with an estimated CAGR of 6-7%.

In the cotton or cloth diaper segment, there are following competitors:

- Bumberry - Cloth diapers catering to 0 to 3 years and adult diapers, less category diversification

- Bumpadum - No website sales, only available on marketplaces

- Tickles - Only caters to kids from 0 to 3 years for diapers and bibs

- A toddler thing - Have expanded to kids apparel with existing cotton diapers & nappies

- Snugkins - Primary focus is diapers & potty training apparel with expansion in all clothes for kids

- Newboo - Sells 1 type of diaper only

- KiddieHug - Have expanded to kids apparel with existing cotton diapers & nappies

- Mother Sparsh - Started with toiletries for kids and have expanded to all kids products along with diapers

- Bumtum - No website, only available on marketplaces

- BabyHug - Selling disposable, cloth diapers and other baby products too, complete range of

There are also other companies that are selling disposable bamboo diapers that ensure the sustainability and dry feel with no need for washing and has been gaining traction. Key player in this segment is Allter but their challenge is the price point is very high compared to any of the other disposable or reusable diapers in India.

Product categories:

With a lot of trial & error and international tests & certifications, Superbottoms launched their padded buttoned diapers first. This was followed by a variety of diaper products over the years like UNO, UNO 2.0, padded underwears, potty training pants, etc. and now they have launched more categories and products for kids (0 to 8 years) and women (12 to 50 years). Speaking with mothers have given them a social edge over competitors with their products that cater to kids with special needs, older kids who bed-wet, nursing pads, bladder lead underwears of postpartum women, etc.

Broadly categorizing with respect to products and users:

A. Children (0 to 8 years) - Cloth diapers, langot, wipes, pants, potty training underwears, regular underwears, kids apparel, bibs, swaddle, seed pillows, diaper changing mats, underwear for kids with special needs, underpants for older bed-wetting kids, etc.

B. Parents (Gender agnostic) - Diaper bag, detergent, travel bags, planters, etc.

C. Women (Menstruating and Moms) - Period underwear, cloth sanitary napkins, nursing pads, bladder leak underwear, etc.

D. Gifting - Gifting options for baby shower, naming ceremonies, birthdays, etc. for moms with newborns or toddlers that includes actual product combos as well as gift cards

User Interviews:

For this project, I interviewed retained customers, with their latest purchase done in the last 2 months. This has given me latest insights & also the user/customer has been more aware of the product. User interviews were conversational where I tried to understand their demographic, pain points and current solutions. A clear question asked before starting the interview was if they liked Superbottoms products and if their last purchase was a recent one and only the ones that said yes are considered for this assignment. Following are some snippets from the conversations:

User 1 (26/F) - A working mom (currently on sabbatical) of a 15 month old, first used Superbottoms 8 months ago (UNO 2.0) and have not tried other product categories but continued buying more of the same product, first heard about the product through Instagram ads.

Words/Adjectives used -- Soft, dry feels, convenient to wash and maintain, lasts for long, good for rainy season, trial pack availed, aware about demo

User 2 (36/F) - A working mom of a 7 month old, first used Superbottoms when her son was 2 month old due to diaper rashes, got to know about it from online mom community and exploring more products as they are launched.

Words/Adjectives used -- Absorbent, Snug fit, Less changes than langot, In-between disposable and cotton cloth, trial pack not availed, not aware about demo

User 3 (30/F) - A homemaker raising a 15 month old in a joint family, have tried various brands, got to know about Superbottoms from family friends, primarily use UNO 2.0 and padded underwears.

Words/Adjectives used -- Good prints, dry feels, expensive initially but value for money in the long run,

convenient to use, rash free bottoms, trial pack availed, demo availed

User 4 (31/F) - Working mom of a 2.3 year old toddler, have been using Superbottoms for almost 2 years and have used a bunch of their products for her child. She is also active in the mom communities and loves to contribute to both questions & answers in the community. She searched online and found Superbottoms for her diapering needs. She is aware of the female hygiene products sold but has never brought any.

Words/Adjectives used -- Convenient, Dry feels, Good absorption, additional pads for night use, easy to wash, less space needed to carry when I visit my parents, fun prints, trial pack availed, not aware about demo

User 5 (32/M) - Working father of a 20 month old, have been using Superbottoms for 1.5 years and have used a couple of products for the kid, research and purchase done by wife, is not aware of female hygiene products they sell

Words/Adjectives used -- Easy to put on the baby, easy to wash the poo, good absorption, better sleep for the baby & parents, plays on the bed without worry of leakages, trial pack availed, not aware about demo

A very strong point that came out during the user interviews, online reviews as well as sales data readily available about Superbottoms is that although quite a few men contribute in cleaning and changing the diapers, the buying decision still lies with the mother in 90%+ households. Even the washing decisions like handwash vs machine-wash, self vs maid/nanny, detergent brand, etc. are taken by the women or mother of the child. Hence, they would make up the primary ICP and also it is clear why Superbottoms is focusing on more women centric products as well, owing to the already built trusted network of women.

The only user I could not find to interview were active users of the women specific products, even when mothers were aware of these products. One of the reasons they haven't tried these products is because their daily life is so busy that they don't have time to try new period related products. Another reason was that they already purchased nursing pads (disposable, non-disposable) from other brands before delivery and don't find a need for it anymore. Albeit these products are recent launches & while Superbottoms is actively advertising them on social media, actual flow of customers willing to use these would be gradual.

As for the kids products, one product that all customers have tried is the UNO 2.0 i.e. their USP product and still continue to use it daily. They also recommend this product to new mothers in their friends and family circles.

ICPs:

Looking at the retained customers, products the company sells and what products they also want to increase sales for, we have 3 different ICPs with different pain points and solutions.

ICP Name | ICP 1 - Parent who is interested in all kids products | ICP 2 - Parent looking only for diaper alternatives | ICP 3 - Women interested in products other than diapers |

Age | 22 - 45 years | 22 - 45 years | 12 - 50 years |

Gender | Female | Female | Female |

Location | Tier 1, 2, 3 cities | Tier 1, 2, 3 cities | Tier 1, 2 cities |

Income Levels | 10 LPA+ | 8 LPA+ | 10 LPA+ |

Marital Status | Married | Married | Married and Unmarried |

Apps they use most | Instagram, Facebook, Whatsapp | Instagram, Facebook, Whatsapp | Instagram, Facebook, Whatsapp |

Needs | Safe, chemical free products for my child's private parts Products that are soft and comfortable | Products that are good for my child’s skin | Alternative options for disposable sanitary napkins, tampons, disposable nursing pads |

Pain Points | Leakages in regular langots, rashes caused by disposables, issues in potty training by consistently using disposables | Rashes caused by diapers, unable to maintain cotton langots | Shortage of sustainable options that are easy to use, stain/leakproof, clean and easy to maintain |

Solutions | Cloth diapers, padded underwear, cloth langots, diaper rash creams, toxin free detergents | Cloth diapers, padded underwear, cloth langots, diaper rash creams, toxin free detergents | Period panties, menstrual cups, cloth as nursing pads |

Frequency of product use | Daily | Daily | Monthly |

Frequency of platform use (Buying frequency) | Once in 2 months / Quarterly | Quarterly / Semi-annually | Semi-annually / Annually |

Willingness to pay | High | High | High |

ICP Selection Process:

ICPs are selected based on the user interviews by combining commonalities between the different users based on buying habits, demographics, problem statements and usage frequency.

For the primary products where there are considerable number of retained users, ICP 1 and ICP 2 are more fitting and for the up & coming products where there is still limited awareness and usage, ICP 3 is more relevant. These ICPs are also finalized after reviewing customer feedback & reviews on online channels.

To reiterate the 2 ICPs who are the focus of the teardown and onboarding journeys would be ICP1 (Parents who are looking for all kids products) and ICP2 (Parents who are only looking for diapers) as they are the primary retained users and can enable us to find the activation milestones, aha moments and consecutively the activation metrics, while JTBD can be elaborated for all 3 ICPs.

Influencers and Blockers:

Primary influencers could be family, parent support groups/communities, their spouses, doctors, nanny/maids, etc. where they may either introduce the product or after introduction, share the benefits of using such products for both the child as well as the parent.

While family can be an influencer in these purchases, they can also act as a blocker stating thing like "Cotton cloth is better" or "We will not put these in the washing machine, hand wash if you want to use them", etc.

Jobs to be done:

Based on user interviews the primary job that all parents want for their kids while using a superbottoms products is to be leakproof. There are benefits that the quality and make provide which makes it a better alternative to competitors but eventually the task for the product is to ensure pee and poop do not spill everywhere. Therefore, the primary goal would be functional in nature with very close secondary goals that would be Personal for certain ICPs.

Goal Priority | Tags | ICP 1 | ICP 2 | ICP 3 |

Primary | Functional goals | To have a leak-proof (pee and poop) day & night To have convenient-to-use and gentle on skin products To use products that are easy to maintain and last longer i.e. grow with my baby To have more control over the amount of chemicals that my child is exposed to | To have a leak-proof (pee and poop) day & night To use a product that is easy to maintain and has a longer shelf life To use a product where the category ranges from 3 months to 8 years catering to my growing baby's needs | To be leak-proof and stain-free during periods or when facing bladder leakages (associated with pregnancy & postpartum) To be leak-proof and stain-free during my nursing phase |

Secondary | Personal goals | To have a happy, well slept, rash-free kid leading to happy, well slept parents To keep my hands soft by not hand washing big loads of cotton langots, beddings, clothes, etc. | To have a happy, well slept, rash-free kid and in turn have happy well slept parents To save time for other tasks with a reduced laundry load | To have less chemical exposure to sensitive body parts and feel comfortable in what you wear |

Secondary | Social goals | To have attractive fun prints that look good while travelling or visiting friends and family | - | - |

Secondary | Financial goals | - | To get value for money in the long run by spending less on disposable diapers | To reduce the monthly expenses on sanitary napkins & panty liners |

Product Teardown:

While Superbottoms products are sold from their platform as well as other retailers (online & offline), for the onboarding project we are only focusing on their platform. Owing to this we first check the lead distribution to finalize the right platform to be assessed. After a quick check for recent users, we have the following data:

Since 96%+ users come to the platform using their mobile devices, that would be the ideal platform for the teardown. I am using an android device to do the onboarding teardown.

Another point to note is that this is a d2c platform that gives the customer a chance to see everything on the platform before collecting more information from them. So there are activation milestones placed across the website which the user can reach from any screen or flow. Because there is no fixed flow or set of steps that the user takes to reach the milestones, we will analyze all screens that can lead to the milestones and do a teardown without focusing a lot on sequence.

Detailed teardown of the mobile web journey:

GrowthX Onboarding Teardown.pdf

Summary of the onboarding teardown:

The onboarding experience feels like that of a homegrown d2c brand where product categories are highlighted upfront along with a primary and may be a secondary theme going on the first few folds. The two clear themes that came out of the first few folds and copy were "Discounts/Offers/Lower prices" and "Absorption, dry feel". The product images and graphics are well placed throughout the journey to keep the user engaged and build a trust on what to expect in the final delivered product. Images also depict how the product would look like in shape and how it would fit the customer after wearing.

Using the right celebrities & influencers and showing their journey and recommendations upfront helps build trust for a new parent. The major takeaway for me are the "trial pack" - which no one is doing or heavily promoting in this category, shows that Superbottoms is confident that you will like the product and "book a demo" - a very unusual thing for a diaper brand but shows that they know that this is an involved purchase (not an impulse) and the customer may need some convincing to go ahead and buy. They have thoroughly used priming and progressive disclosures throughout the website, building a story and keeping the customer engaged to ensure the sale happens.

Better copy at certain places (as highlighted in the pdf) could do wonders in communicating the right things to the customer. Placement of blogs and SEO content can be improved to add further value to the customer's journey. Also, this is a fairly new category, I spoke to a few non-parents in their late 20s and early 30s and they were unaware and in awe of such a product's existence. This begs the question - how important is it to explain the user 'what the product does' and 'how to use the product'. These 2 questions are not clearly answered in the initial slides and the user needs to click atleast 2-3 times on the website to reach a point where this is well put. Although the physical product comes with a detailed pamphlet on how to use the product, this information should come out clearly and obviously early on in the user journey.

Also, certain screens and CTAs are overloaded with information that can break the purchase journey and lead to drop-offs. These need to be worked upon as mentioned in the recommendations.

Activation Metrics:

Different users may experience different Aha! moments depending on the route they choose to buy the product:

Aha moments and user journey for user going via the trial product route:

Aha moments and user journey for user going via the free demo route:

Aha moments and user journey for user choosing to by the product they want (w/o trial or demo) i.e. majority users journey would be this:

The primary metric or goal that the company wants to achieve is increased sales from both new users as well as existing users. Activation metrics can be related to direct sales done in a period of time or could be a strong enabler for sales in a given time period. A secondary metric to track would be cross-selling outside category for the same user (child) or category for another type of user (woman).

Following are the hypothesis for activation metrics that could directly or indirectly contribute in increasing sales.

Hypothesis 1: Customers buying the trial pack in 30 days from first landing on the platform

Reasoning: Choosing a diaper is an involved buying process specially a cloth diaper because you have to also plan for the process after purchase. How frequently and who would change it, how often would you wash them, would you handwash or machine wash, who would do the full handwash or basic cleaning/soaking before putting it in the machine and when, etc. need to be answered for the customer. Another question that arises is how many would you need to go buy the day & night i.e. 24 hours with enough supply for the next day because it takes a while for these to dry. Buying a trial pack can help check if this is the right choice for the customer & their family and it should be done in the 1st 30 days else it is very unlikely that they will return to buy.

Hypothesis 2: Customers doing the first transaction in 30 days of first landing on the platform

Reasoning: A transaction done in the first 30 days ensures activation with one of the milestones placed across the journey. Due to the product categorization, testing and feedback driven modifications, once atleast a single transaction is done, chances of repeat buying increase drastically. Also, beyond 30 days, it is challenging that the customer would come back to buy the product.

Hypothesis 3: Customers booking a demo (virtual or at home) in 2 weeks from first landing on the platform

Reasoning: Customers booking a demo are put in touch with another mother who has used Superbottoms (may be an employee or strong community partner) who would detail out benefits more clearly. They would also be in a good position to nudge the buying process, encourage trials and show the look & feel of the product. New mothers tend to look for guidance & support with experienced mothers for various things related to the baby & postpartum and the trust on another mother is generally high leading to conversions and purchase.

Hypothesis 4: Customers signing up (by adding products to the cart or creating a wishlist) within 15 days

Reasoning: By selecting the products they are interested in and signing up, the user has given a clear indication of intent along with product for which buy intent exists. Their buy journey may have paused due to various reasons like wanting to discuss it with someone before buying, physical break (had to close the site), low battery, etc. Nudging these customers with good communication touchpoints along with additional offers & discounts can lead to a higher conversion rate.

Hypothesis 5: Customers buying the trial have not returned the product in 30 days

Reasoning: If a customer has not returned the trial products, chances are high that they liked and are using the product regularly (maybe even daily). The recall value once you start using the product is high as you are frequently holding and seeing it. This recall value and comfort with the product along with added nudges and communication touchpoints may lead the customer to come back to the platform and buy more products from other categories or repeat buy the same products.

Metrics to track effectiveness:

Quantitative:

- For this category, D1, D7 and D30 metrics i.e. number of users who came on D0 and are coming back on D1/D7/D30 would not be valid because once the user has made a purchase, the next purchase can take 60 to 90 days even for the primary ICP.

- In this case, post 1st purchase, M2 and M3 would be viable targets to look for and track retention.

- Number of

- Time taken to place an order after adding the product to cart

- Time taken to place the order after landing on the website

- Time taken to book a demo after landing on the website

- Orders per month per category

- Number of users buying from a different category within 30 days of last purchase

- Average delivery TAT

- Increase in number of community members per month for each platform (Facebook, Instagram & Whatsapp)

- Increase in number of demos booked vs completed per month

Qualitative:

- Feedback on Quality of the product

- Customer reviews

- NPS

- CSAT

- Joined Facebook community after the first product is delivered

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.